Remember the piggy bank? That ceramic friend was the peak of financial technology for most of us as kids. But in today's digital world, cash is becoming less common, and teaching kids about money requires a different set of tools. How do you teach them to earn, save, and even invest when they see you just tap a card or a phone to buy things? That's the question I was asking myself a couple of years ago.

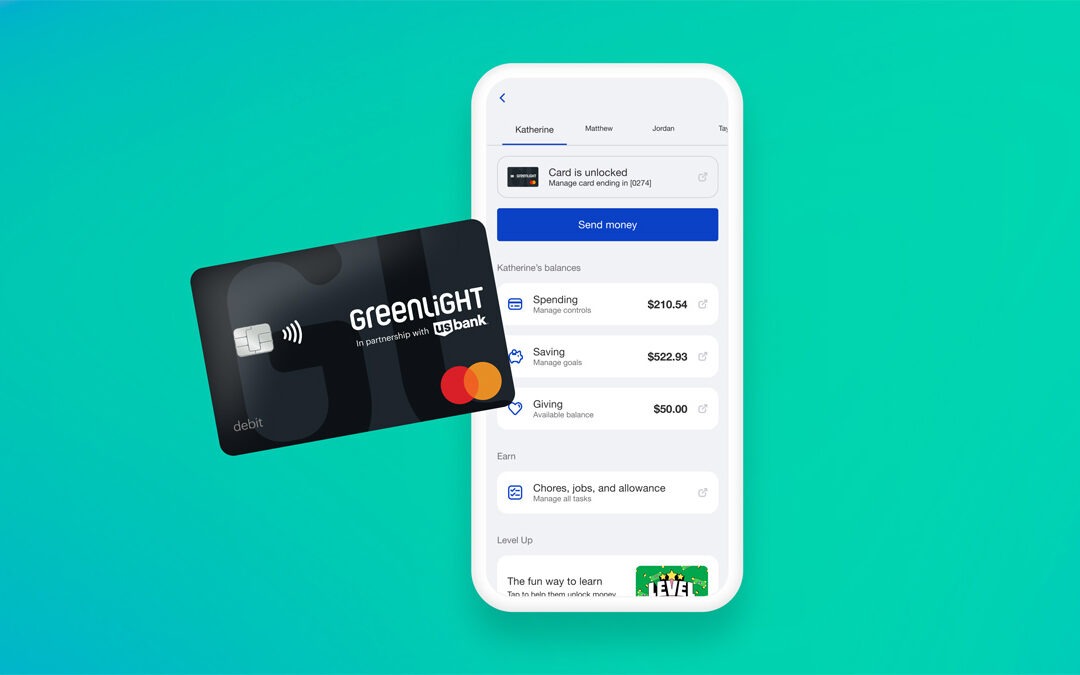

The answer for our family has been the Greenlight debit card for kids. It’s more than just a piece of plastic. It’s a complete system that has given my elementary school-aged kids financial independence in a safe, controlled way.

In this review, I'll share our firsthand experience with Greenlight, why we specifically love the "Max" plan for its investing features, and how you might even get it for free.

What Exactly Is a Greenlight Card?

First things first, Greenlight is not a credit card. You don't have to worry about your child accidentally racking up debt. It's a prepaid debit card that you, the parent, control completely through an app on your phone.

Here’s how it generally works:

- You Add Money: You can transfer money from your bank account to the Greenlight app instantly or set up automatic allowances.

- You Set the Rules: You can set spending limits for specific stores or categories. For example, you can allow spending at bookstores but not on certain gaming websites.

- They Learn to Manage: Your kids get a physical debit card with their name on it, which they can use to make purchases in stores or online, within the boundaries you've set.

- Chores & Allowance: You can assign chores in the app. Once they mark them as complete, their allowance is paid out. This directly connects the idea of work and earning.

Greenlight offers a few different plans, but the one that truly changed the game for our family was the Max plan.

Why We Chose Greenlight Max: Investing for the Next Generation

While the basic debit card and chore features are great, the real magic for us is the investing platform included with the Greenlight Max plan. I knew I wanted to teach my kids about the stock market, but the idea felt abstract and complicated. Greenlight made it simple and accessible.

Making Investing Tangible for Kids

With Greenlight, my kids can invest in fractional shares of their favorite companies. Instead of needing hundreds of dollars to buy one share of a big company, they can invest as little as $1. Suddenly, the stock market wasn't some scary thing on the news. It was owning a tiny piece of companies they already knew and loved, like Disney, Apple, or Roblox.

The best part is the parental control. My kids can research stocks and request a trade, but I have to approve every single purchase or sale. It’s the perfect training ground. It allows them to learn and make decisions, but with a safety net. This early exposure to the financial markets is an invaluable lesson that I wish I'd had at their age.

A Fantastic Perk for US Bank Customers

Here’s a great tip: the Greenlight Max plan is completely free if you have a qualifying US Bank account. This is the route we took, and it saved us the monthly fee, making an already great tool an even better value. If you're a US Bank customer, it's definitely worth looking into.

Beyond Investing: Gaining Independence and Responsibility

The investing feature is the star of the show for us, but the everyday benefits are just as important. Having their own Greenlight debit card for kids gives them a sense of independence. When we go to the store, they can pay for a small toy or a treat with their own money. It teaches them to check their balance and think about whether a purchase is truly worth it.

While we don't need the more advanced features yet, it's nice to know they exist. Other plans offer things like SOS alerts, crash detection, and identity theft protection. These are features that will become more relevant as my kids get older and start driving, giving the app the ability to grow with our family.

Is Greenlight the Right Choice for Your Family?

For us, the answer has been a resounding yes. The Greenlight debit card for kids has been an incredible tool for teaching financial literacy in a practical, hands-on way. It has given my kids the independence to manage their own money while giving me the peace of mind that they're learning in a safe and controlled environment. The early exposure to investing is a lesson that will hopefully serve them for the rest of their lives.

If you're ready to give your kids a head start on their financial journey, I can't recommend it enough.

Ready to try it? Earn $30 when you sign up for Greenlight using my referral link. With the money app and debit card for kids and teens, you can send your kids money instantly, assign chores, and teach them to earn, save, and invest.

What's the most important money lesson you hope to teach your children? Share your thoughts in the comments below!